March 24, 2023

Canlan Solidifies Its Growth Footing With Strong 2022 Operations Performance, Renewed Lending Facilities and U.S. Expansion

Burnaby, B.C., March 24, 2023 – Canlan Ice Sports Corp. (the “Corporation”) (TSX: ICE) today reported its financial results for the year ended December 31, 2022.

Burnaby, B.C., March 24, 2023 – Canlan Ice Sports Corp. (the “Corporation”) (TSX: ICE) today reported its financial results for the year ended December 31, 2022.

Overview of Year Ended December 31, 2022

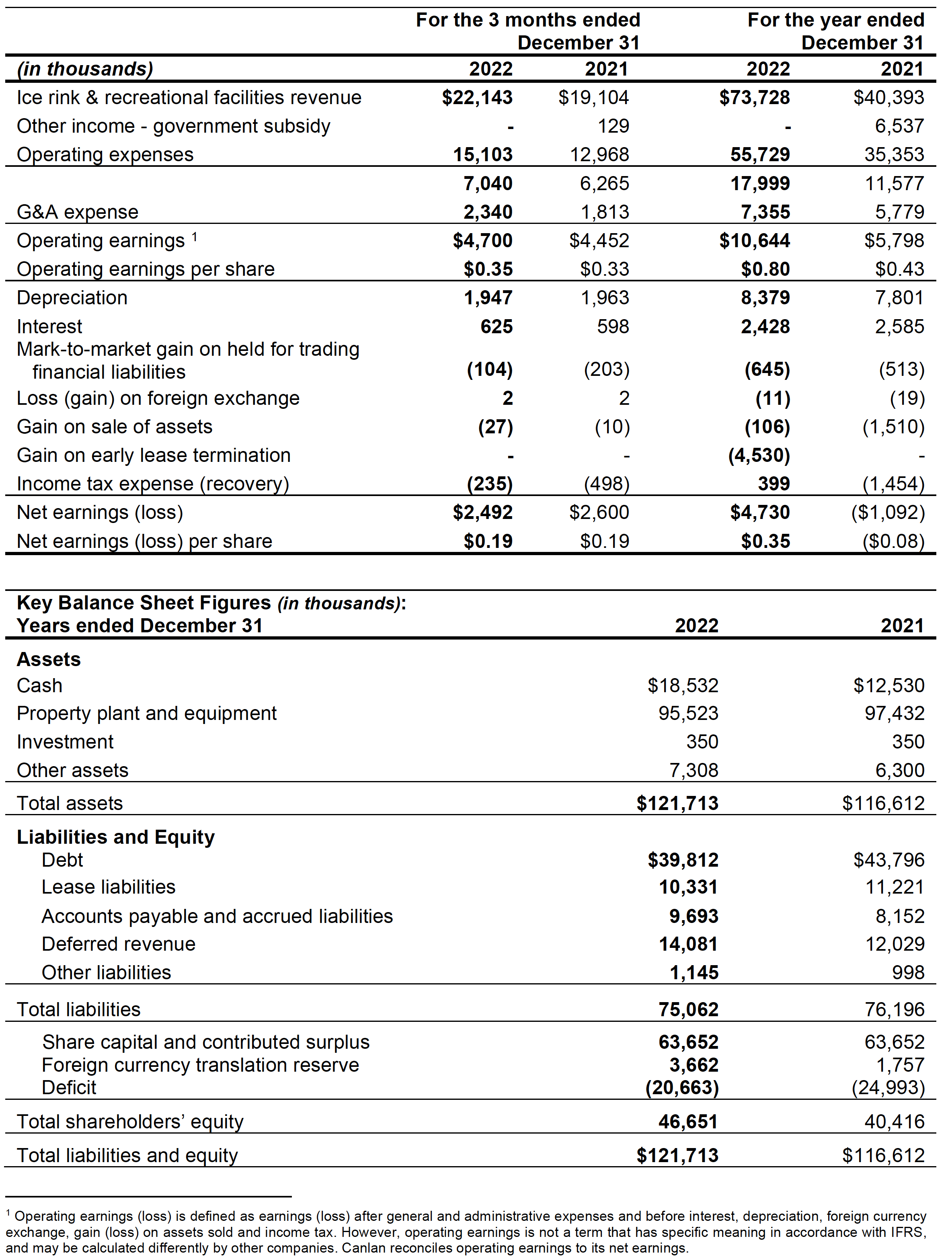

- Total operating revenue of $73.7 million increased by $33.3 million compared to a year ago;

- Same-facility ice, field and court revenue reached approximately 93% of FY2019 prepandemic levels (Q4 2022 reached 100% of Q4 2019);

- Operating earnings of $10.6 million increased by $4.8 million compared to a year ago;

- The Company completed another significant phase of its roof remediation program ($2.3 million expense) after pausing the projects temporarily during the pandemic;

- Net earnings for the year was $4.7 million compared to a net loss of $1.1 million in 2021;

- The Company refinanced its bank credit facilities with a package that reduces cash requirements on annual debt service by approximately 37% and fixes interest rates until 2027 at 5.50% or lower on 87% of its debt to reduce interest rate risk. As at the date of this release, $25.5 million of credit lines are available for operating and capital requirements;

- Cash consideration of $4.5 million was received in September 2022 to surrender the Company’s lessee position of a sports complex lease prior to the maturity date of the lease agreement;

- By end of 2022, 60% of the Company’s ice re-surfacers have been transitioned to electrified models, which helps to reduce carbon emissions and improve facilities’ air quality. The electrification program, along with investments in new roofs and enhanced building automation systems, are green initiatives that will be continued in the coming years;

- The Company reviewed its dividend policy in November 2022 and resumed a quarterly dividend distribution of $0.03 a share; and

- Subsequent to year end the Company exercised its option to purchase Canlan Sports Libertyville in Libertyville, Illinois, further affirming the Company’s long-term commitment to its U.S. expansion strategy.

“Fiscal 2022 was an outstanding bounce-back year for Canlan. After responding to health orders that closed Ontario operations for the month of January 2022, our teams had to manage the impact of labour supply shortages that were prevalent throughout the service sector. In addition, we also had to continuously revise schedules, product offerings, and menus to adapt to changing customer needs and supply chain issues from our vendors. At the end of the year, we achieved over $73.0 million in revenue, which represented a year-over-year increase of 82%. But more importantly, Q4 same-facility sales reached 100% of 2019 (pre-pandemic). To me, this is the static test of recovery from COVID-19 disruptions, and in 2022, our team certainly met this challenge,” said Canlan’s CEO, Joey St-Aubin. “Not only did we get back to normal and busy operations for our sports complexes, we got started on a number of key strategic initiatives, created sustainable cost efficiencies and these new initiatives are aimed at significantly enhancing the customer experience in the coming years.”

Fourth Quarter and Annual Results

2022 Year End Results

(year ended December 31, 2022 compared with year ended December 31, 2021)

- Total operating revenue of $73.7 million increased by $33.3 million compared to 2021 as facilities resumed full operations and COVID-19 health restrictions were lifted;

- Facility operating expenses of $55.7 million increased by $20.4 million or 57.6% compared to 2021 due to a resumption to full operations and the completion of significant roof and maintenance projects, some of which were deferred from the previous two years;

- After G&A expense of $7.4 million, operating earnings were $10.6 million compared to $5.8 million in 2021. Excluding $6.5 million of government subsidies in the prior year, 2021 had an operating loss of $0.7 million;

- A gain on early lease termination of $4.5 million was recognized as the Company surrendered its lessee position of a sports-complex-lease prior to the maturity date of the lease and extension-option of the lease agreement in September 2022; and

- Net earnings after this gain, depreciation, interest expense, income tax, and other miscellaneous income, were $4.7 million or $0.35 per share compared to a net loss of $1.1

million or $0.08 per share in the prior year.

Fourth Quarter Results

(three months ended December 31, 2022 compared with three months ended December 31, 2021)

- Total operating revenue of $22.1 million increased by $3.0 million or 15.9% compared to 2021 as operations returned to 100% capacity in 2022. 98% of business from ASHL and contract users have returned during the fall/winter season;

- Operating expenses $15.1 million increased by $2.1 million or 16.5% from the prior year which was consistent with the increase in revenue;

- After G&A expenses of $2.3 million, operating earnings of $4.7 million increased by $0.2 million or 5.6% for the quarter compared to 2021. Operating margin was 21.2% of revenues in 2022 compared with 23.3% in 2021 and 18.8% in 2019; and

- After depreciation, borrowing costs, and income tax recovery of $2.2 million (2021 – $1.9 million), net earnings for the quarter were $2.5 million or $0.19 a share compared to $2.6 million or $0.19 a share a year ago.

“In addition to the achievements already mentioned, we ended the year with $10.6 million of operating earnings, which exceeded our original targets, and our positive liquidity position put us in good shape to resume quarterly dividends, as approved by our Board of Directors,” added the company’s CFO, Ivan Wu. “On February 28, 2023, we also exercised our option to purchase the non-ice sportsplex facility called Canlan Sports Libertyville in Libertyville, Illinois. This facility was already being leased by Canlan from the Village of Libertyville under a twoyear lease agreement since July 2021. We look forward to being able to provide Libertyville and the surrounding communities with a class-leading sportsplex in which to play and lead active lifestyles for the long term.”

Dividend Policy

When the COVID-19 pandemic began, measures were implemented by management to

preserve cash balances. Given this, combined with the austerity that was asked of our

employees, directors, our customers, our suppliers and our financial partners, Canlan’s Board

of Directors suspended the payment of dividends on March 24, 2020. Given the return of full

operations and the Company’s relatively strong liquidity position, Canlan’s Board of Directors

has approved the resumption of the Corporation’s quarterly dividend distribution. As such, the

Board declares eligible dividends totaling $0.03 per common share that will next be paid on

January 16, 2023 to shareholders of record at the close of business December 29, 2022.

Canlan’s Board of Directors reviews the Corporation’s dividend policy on a quarterly basis.

Filings

Canlan’s financial statements and Management’s Discussion & Analysis for the period ended

September 30, 2022 will be available via SEDAR on or before November 14, 2022 and through

the Company’s website, www.canlansports.com.

About Canlan

Canlan Ice Sports Corp. is the North American leader in the development, operations and

ownership of multi-purpose recreation and entertainment facilities. We are amongst the largest

private sector owners and operators of recreation facilities in North America and currently own,

lease and/or manage 17 facilities in Canada and the United States with 49 ice surfaces, as well

as five indoor soccer fields, and 20 sport, volleyball, and basketball courts. To learn more

about Canlan please visit www.canlansports.com.

Canlan Ice Sports Corp. is listed on the Toronto Stock Exchange under the symbol “ICE.”

Caution concerning forward-looking statements

Certain statements in this News Release may constitute ”forward looking” statements which

involve known and unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Corporation to be materially different from any

future results, performance or achievements expressed or implied by such forward looking

statements. When used in this News Release, such statements may use such words as ”may”,

”will”, ”expect”, ”believe”, ”plan” and other similar terminology. These statements reflect

management’s current expectations regarding future events and operating performance and

speak only as of the date of this News Release. These forward looking statements involve a

number of risks and uncertainties. Some of the factors that could cause actual results to differ

materially from those expressed in or underlying such forward looking statements are the

effects of, as well as changes in: international, national and local business and economic

conditions; political or economic instability in the Corporation’s markets; competition; legislation

and governmental regulation; and accounting policies and practices. The foregoing list of

factors is not exhaustive.

For more information:

Canlan Ice Sports Corp.

Ivan Wu

CFO

604 736 9152