August 12, 2023

Canlan Reports Record Revenue and Operating Earnings for Q2 2023 and Continues Quarterly Dividend

Burnaby, B.C., August 11, 2023 – Canlan Ice Sports Corp. (the “Corporation”) (TSX: ICE) today reported its financial results for the second quarter ended June 30, 2023.

Burnaby, B.C., August 11, 2023 – Canlan Ice Sports Corp. (the “Corporation”) (TSX: ICE)

today reported its financial results for the second quarter ended June 30, 2023.

Overview of Q2 2023

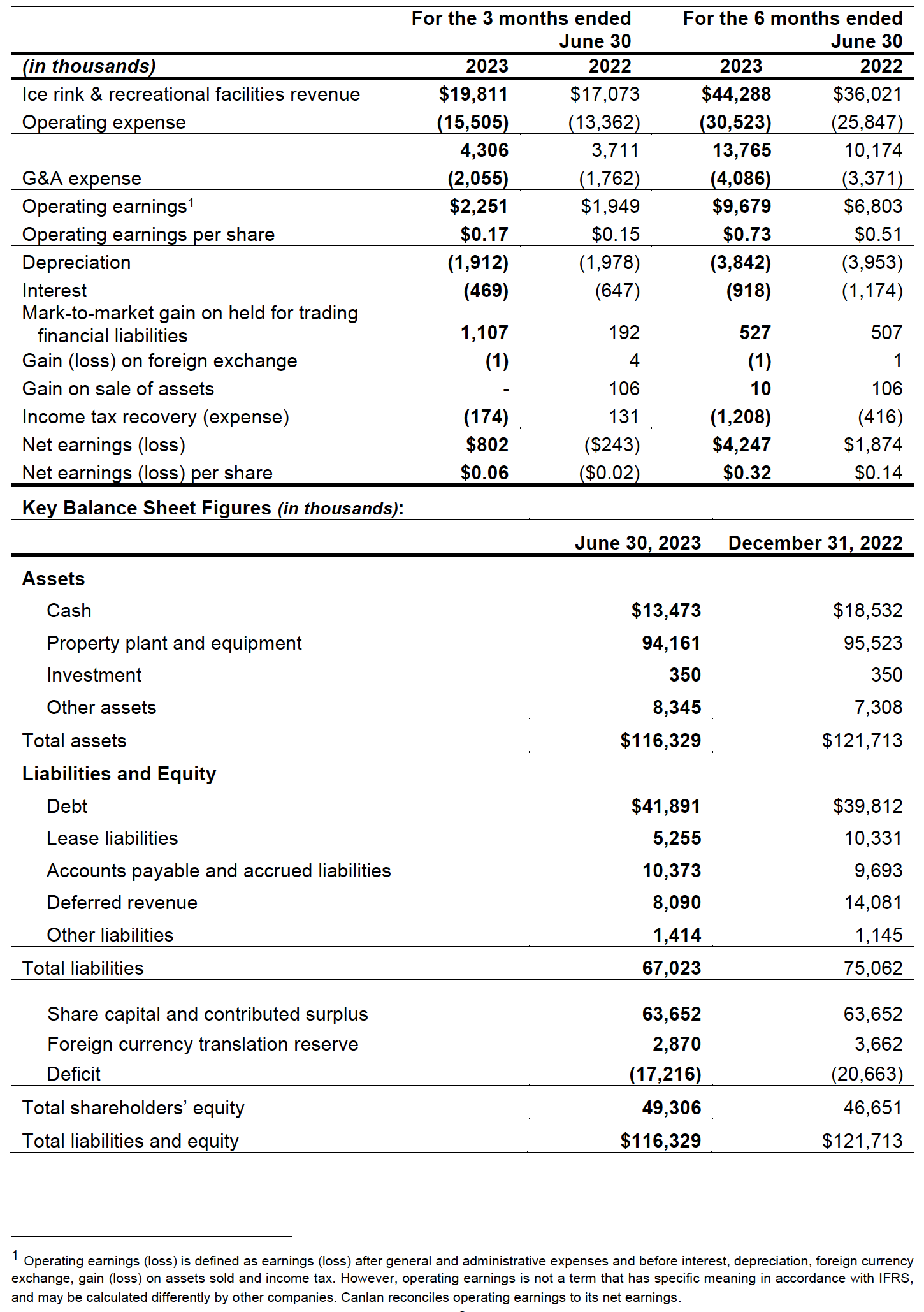

- Operating revenue of $19.8 million increased by $2.7 million or 16.0% compared to

2022; - Total operating earnings of $2.3 million increased by $0.3 million or 15.5%;

- Food and beverage revenue was up 45.7% resulting from increased tournament,

league and programs traffic; and - The Company’s roof remediation program restarted for this year as scheduled, and

capital projects to replace HVAC and refrigeration equipment were largely completed

during the quarter. These projects are anticipated to make positive impacts on the

reduction of energy cost and carbon emissions.

Three Months and Six Months Ended June 30, 2023 Results

Second Quarter Results

(three months ended June 30, 2023 compared with three months ended June 30, 2022)

- Total operating revenue of $19.8 million increased by $2.7 million or 16.0% compared to

2022 as surface rentals, leagues, tournaments, programs, and restaurants all experienced

higher business volumes; - Total operating expenses of $15.5 million increased by $2.1 million or 16.0% mainly due to

increased customer volumes; - Total G&A expenses of $2.1 million increased by $0.3 million or 16.6% mainly due to

increased costs to enable the Company to execute significant components of its strategic

plan; - After G&A, operating earnings was $2.3 million compared to $1.9 million in 2022; and

- After recording depreciation expense of $1.9 million, finance costs of $0.6 million, and

income tax expense of $0.2 million, net earnings were $0.8 million or $0.06 per share

compared to a loss of $0.2 million or $0.02 per share in the prior year.

Six Months Ended June 30, 2023 Results

(six months ended June 30, 2023 compared with six months ended June 30, 2022)

- Total operating revenue of $44.3 million increased by $8.3 million or 23.0%;

- Total operating expenses of $30.5 million increased by $4.7 million or 18.1% as a result

of increased volumes;/li> - Operating margin before G&A was 31.1% compared to 28.2% in 2022;

- G&A expenses of $4.1 million increased by $0.7 million or 21.2%;

- Operating earnings before interest, depreciation and taxes was $9.7 million compared

to $6.8 million in 2022; and - After recording depreciation expense of $3.8 million, finance costs of $0.4 million, and

income tax expense of $1.2 million, net earnings were $4.2 million or $0.32 per share

compared to $1.9 million or $0.14 per share in the prior year.

“During the first half of 2023, our teams’ strong execution in all areas resulted in year-over-year

increases in participant registrations in virtually all of our internal programs and revenue from

surface rentals have exceeded our targets as well,” said Canlan’s President & CEO, Joey St-

Aubin. “This has also led to significantly higher traffic into our sports bars and concessions. I

want to thank the Canlan team for the hard work and the positive results achieved so far in the

midst of a challenging economic environment. We look forward to servicing a greater number

of customers and players in the second half of the year.”

Canlan’s CFO, Ivan Wu, also added that a number of major capital and maintenance projects

that are focused on improving building efficiencies and customer experience have been

completed and many more are in progress, including the Company’s roof remediation program.

Furthermore, the ability to fix borrowing rates on all bank debt facilities in early 2023 has

resulted in decreased cash required for debt service.

Dividend Policy

Canlan’s Board of Directors has approved the continuation of the Corporation’s quarterly

dividend policy. As such, the Board declares eligible dividends totaling $0.03 per common

share that will next be paid on October 16, 2023 to shareholders of record at the close of

business September 30, 2023. Canlan’s Board of Directors reviews the Corporation’s dividend policy on a quarterly basis. Canlan’s dividend is designated as an “eligible” dividend under the

Income Tax Act (Canada) and any corresponding provincial legislation. Under this legislation,

individuals resident in Canada may be entitled to enhanced dividend tax credits, which reduce

income tax otherwise payable.

Filings

Canlan’s financial statements and Management’s Discussion & Analysis for the quarter ended

June 30, 2023 will be available via SEDAR on or before August 14, 2023 and through the

Company’s website, www.canlansports.com.

About Canlan

Canlan Ice Sports Corp. (operating as Canlan Sports) is the North American leader in the

ownership, operations and programming of multi-purpose recreation and entertainment

facilities. We currently own, lease and/or manage 17 facilities in Canada and the United States

with 49 ice surfaces, as well as five indoor soccer fields, and 20 sport, volleyball, and

basketball courts. To learn more about Canlan please visit www.canlansports.com.

Canlan Ice Sports Corp. is listed on the Toronto Stock Exchange under the symbol “ICE.”

Caution concerning forward-looking statements

Certain statements in this News Release may constitute ”forward looking” statements which involve

known and unknown risks, uncertainties and other factors which may cause the actual results,

performance or achievements of the Corporation to be materially different from any future results,

performance or achievements expressed or implied by such forward looking statements. When

used in this News Release, such statements may use such words as ”may”, ”will”, ”expect”,

”believe”, ”plan” and other similar terminology. These statements reflect management’s current

expectations regarding future events and operating performance and speak only as of the date of

this News Release. These forward looking statements involve a number of risks and uncertainties.

Some of the factors that could cause actual results to differ materially from those expressed in or

underlying such forward looking statements are the effects of, as well as changes in: international,

national and local business and economic conditions; political or economic instability in the

Corporation’s markets; purchase or sale transactions; naturally caused incidences; competition;

legislation and governmental regulation; and accounting policies and practices. The foregoing list of

factors is not exhaustive.

For more information:

Canlan Ice Sports Corp.

Ivan Wu

CFO

604 736 9152